From rising input costs to disrupted supply chains and fears and threats of retaliatory tariffs, business owners are facing difficult decisions that could ultimately impact American jobs and economic growth. Many small businesses not only export finished goods but also depend on imported components and equipment—meaning these tariffs hit them on both ends, making it harder to remain competitive in international markets.

S Massie Consulting, which works exclusively with small and mid-sized businesses, has heard widespread concern from businesses nationwide. Some fear they may be forced to scale back exports or even relocate operations to mitigate financial strain. Others highlight their struggles to navigate an increasingly uncertain trade environment.

This report explores the realities small businesses now face, the long-term consequences these policies may have, and the fears our clients have expressed.

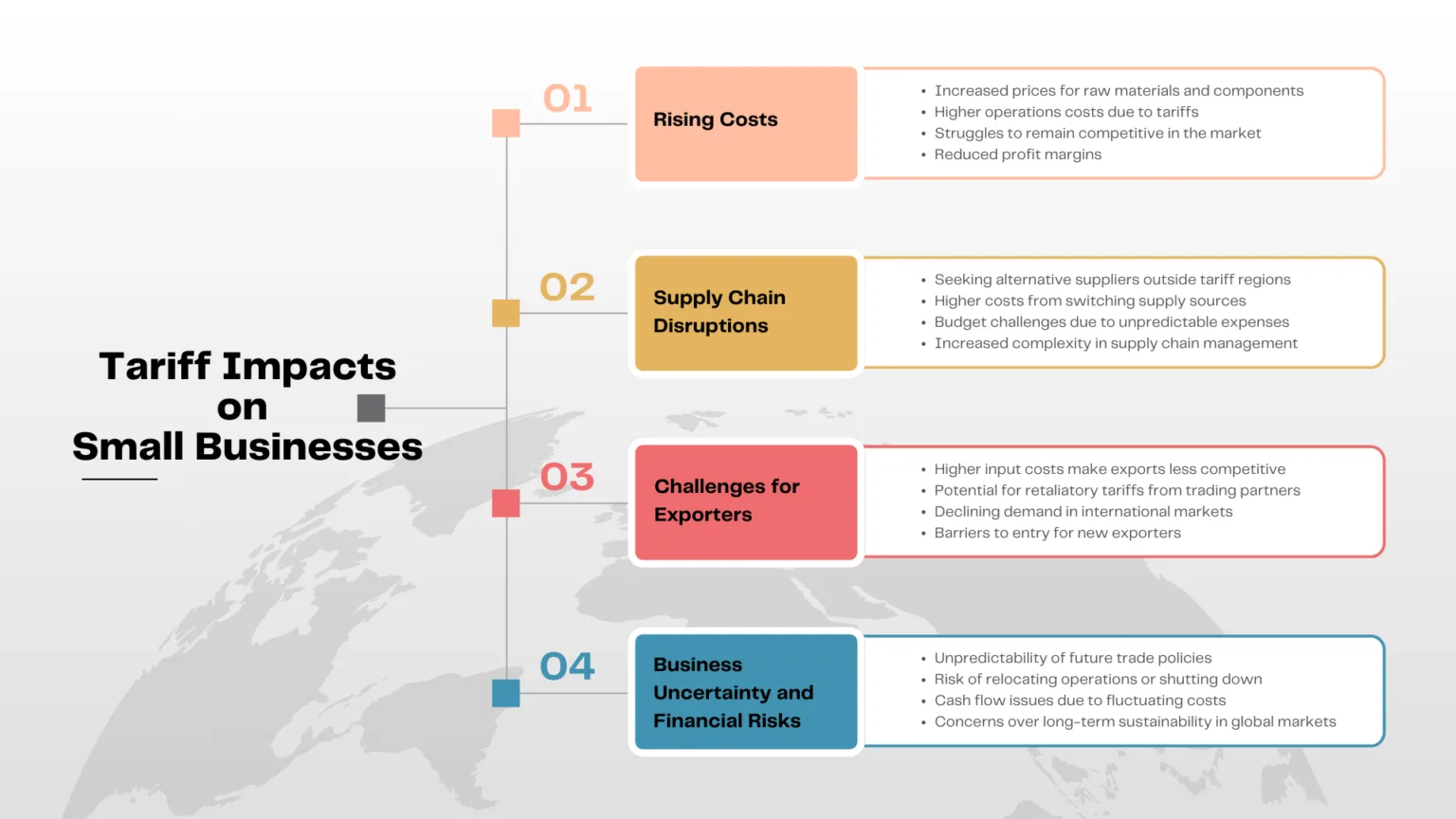

The Impact of Tariffs on Small Businesses

Rising Costs and Uncertain Futures

Recent tariff increases by the U.S. on imports from Canada, Mexico, and China have sent shockwaves through industries that rely on international sourcing. Now, we also have renewed tariffs on steel and aluminum imports.

While tariffs are often promoted as a way to bring manufacturing back to the U.S., they are also currently serving as a political tool aimed at curbing illegal immigration and the flow of fentanyl and other drugs into the country. However, for many small and mid-sized businesses, these tariffs translate into increased costs, disrupted supply chains, and difficult decisions about pricing and survival.

Tariffs Are Raising Costs, Not Revitalizing Manufacturing

This new wave of tariffs, including those recently reported by the Financial Times, The New York Times, BBC, Reuters, and many other outlets, is already affecting U.S. companies. Regardless of industry or political stance, businesses across the board are feeling the financial strain of tariffs.

While large corporations may have the flexibility to absorb costs or adjust supply chains, small or medium-sized enterprises (SMEs) often find themselves with limited options besides passing price increases on to customers. However, when these SMEs take on the losses themselves, the impact is disproportionately severe due to their tighter budgets.

One of our clients, Tim Fulton, CEO and Founder of Ramper Innovations, shared his concerns:

“These proposed tariffs will have a profound effect on my business. It will increase the cost of my raw materials as well as some of the components I get from overseas. One would hope that I could source everything I need from the USA, but that is not the case.”

Supply Chain Disruptions and Difficult Choices

For companies that rely on international raw materials or components, tariffs are already affecting business operations. One client who wished to remain anonymous shared:

“A significant fraction of our materials needed to provide our services are sourced in China, and some of them you simply cannot buy in the U.S. I expect a significant cost increase to be absorbed by our customers (and maybe us), and critical supply chain issues similar to COVID times.”

Another client, whose business depends on sourcing materials from Mexico, echoed similar concerns:

“It will almost certainly have a negative impact on our sales… There are no mills in the U.S. that produce the material we use.”

This client is exploring alternative suppliers in non-tariffed countries but remains uncertain whether those options will be sustainable in the long term. As history has shown, tariffs often escalate, leaving fewer and fewer sourcing alternatives.

This was also expressed through another client’s comments regarding the difficulties of changing sources:

“It is not that easy. It would be a lot more expensive to set up in a new country with the possibility of tariffs eventually increasing there as well.”

The Long-Term Risks: Lost Markets and Potential Business Closures

Beyond immediate cost increases, businesses worry about their long-term sustainability.

Sarah Massie, President of S Massie Consulting, observed:

“Small businesses are being hit on both sides—rising costs on imported materials and shrinking export opportunities due to increased prices and retaliatory tariffs. These policies create uncertainty that makes it harder for businesses to plan, invest, and grow.”

“I am preparing for bankruptcy.”

— Tim Fulton, Ramper Innovations

Exports will certainly be affected for Ramper Innovations, which is already receiving warnings from its customer base:

“I have already been getting feedback that my product is already too expensive. The first round of tariffs [from 2018] …increased my costs substantially.”

The situation is so dire that Tim is considering relocating his manufacturing operations outside the U.S. to remain competitive:

“If materials and components cost me more, I cannot afford to absorb that, so I must pass the cost on to my customers. At some point, my customers will not be willing to pay the amount I pass on to them. I estimate my costs will increase by 18%…”

When asked if his company is preparing for the impacts of these tariffs, Tim replied:

“I am preparing for bankruptcy.”

Limited Impact on Some Industries

Not every business is feeling the effects—yet.

Companies that do not currently import from Canada, Mexico, or China have remained largely unaffected until now. However, with the newly announced tariffs on steel and aluminum applying without exception, even those that previously felt insulated are now bracing for impact. These metals are critical to a wide range of industries, and small businesses that rely on them for production will face rising costs regardless of their country of origin.

There is growing concern that tariffs will continue to be used as a political tool, with uncertainty about which countries or industries might be targeted next. A tariff war with trading partners could further complicate matters for businesses that rely on both importing components and exporting finished products.

One client chose to remain optimistic, telling us:

“It will increase our cost of goods for the parts we purchase from those countries. [But] we recently increased the cost of our products prior to talk of increasing tariffs in certain countries, therefore, we should not feel it as much.”

Unfortunately, this underscores a broader issue—U.S. small businesses are the ones bearing the burden of increased tariffs, not the countries they source from. These added costs are not absorbed by foreign suppliers but instead passed directly to American companies, further squeezing already thin profit margins.

Small Businesses and Exporting: A Growing Concern

Many of our clients across different parts of the U.S. have expressed growing concerns over these tariffs. Industries in regions with strong manufacturing, aerospace, and industrial sectors are particularly vulnerable due to their reliance on international sourcing. Whilst they have a strong focus on exporting finished products in addition to domestic sales, this often involves an amount of importing of materials, components, and equipment. Tariffs will increase these input costs and ultimately increase the cost of finished products.

Small to medium-sized businesses represent 97% of all U.S. exporters. As a company that works exclusively with SMEs, we see firsthand that they are already nervous about exporting. We help them navigate the complexities of U.S. export compliance because there are enormous opportunities in the global market. Their exports bring money into the U.S., which helps small companies and our economy grow.

However, these tariffs may deter companies from starting to export or cause others to pull back from exporting altogether. If this trend continues, it will not help the U.S. trade deficit and could have lasting effects on American small businesses looking to expand internationally.

A Call for Policy Reconsideration

While the intention behind tariffs is to encourage U.S. domestic production and apply political pressure on key issues, the reality is that many small businesses cannot source domestically due to material availability or cost constraints. The added burden of tariffs places them in an impossible position—either raising prices, losing customers, or considering moving operations overseas.

As Tim Fulton bluntly put it:

“I believe these actions are not how you bring manufacturing back into the USA.”

If your business is affected by tariffs, we encourage you to share your story—your voice matters in shaping trade policies that work for, not against, small businesses.

Contact us to schedule a consultation or compliance review.